Why is my refund reduced?

If you owe money to a federal or state agency, the federal government may use part or all of your federal tax refund to repay the debt. This is called a tax refund offset.

If your tax refund is lower than you calculated, it may be due to a tax refund offset for an unpaid debt (for example: property taxes or child support). You will receive a letter from the agency you owe the debt to in the mail.

We cannot discuss your debt with you or discuss payment arrangements to resolve your debt. Only the agency to which you owe the money can do that.

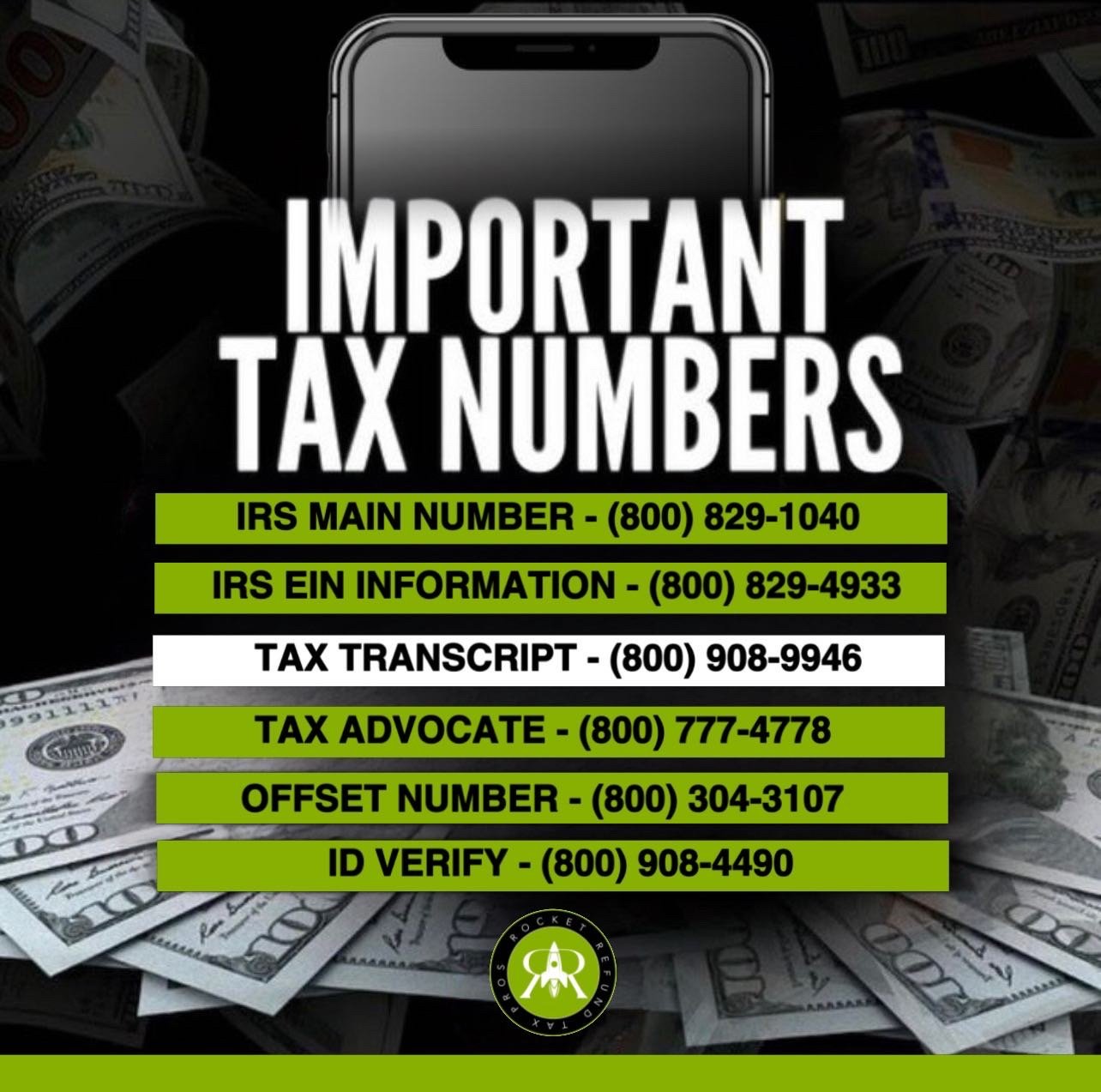

If your payment was reduced because you owed an overdue debt to a federal or state agency, you may call the Treasury Offset Program at 800-304-3107.